Discovering the Benefits and Risks of Purchasing Cryptocurrencies

The landscape of copyright financial investment is identified by a complicated interaction of compelling benefits and significant threats. As we further check out the subtleties of copyright financial investment, it becomes apparent that notified decision-making is vital; nonetheless, the question stays: Exactly how can financiers effectively stabilize these benefits and threats to protect their monetary futures?

Comprehending copyright Essentials

As the digital landscape evolves, comprehending the essentials of copyright comes to be crucial for potential capitalists. copyright is a type of digital or digital money that utilizes cryptography for security, making it tough to fake or double-spend. The decentralized nature of cryptocurrencies, commonly developed on blockchain innovation, boosts their protection and openness, as deals are recorded throughout a distributed journal.

Bitcoin, created in 2009, is the initial and most well-known copyright, yet thousands of choices, called altcoins, have actually emerged considering that then, each with special features and functions. Capitalists must acquaint themselves with essential principles, consisting of budgets, which store personal and public tricks required for deals, and exchanges, where cryptocurrencies can be bought, offered, or traded.

In addition, understanding the volatility related to copyright markets is crucial, as costs can rise and fall considerably within short durations. Governing considerations likewise play a substantial duty, as different countries have varying positions on copyright, influencing its usage and acceptance. By understanding these fundamental components, possible investors can make informed decisions as they navigate the complicated globe of cryptocurrencies.

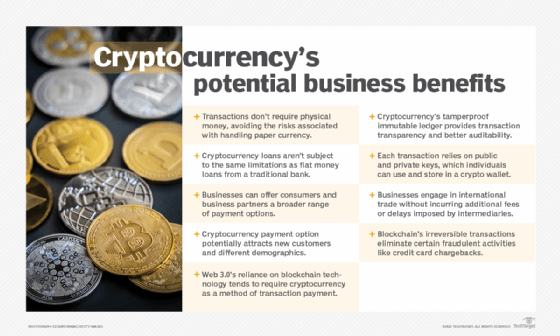

Trick Advantages of copyright Financial Investment

Investing in cryptocurrencies provides a number of compelling advantages that can draw in both newbie and seasoned capitalists alike. Among the primary benefits is the potential for substantial returns. Historically, cryptocurrencies have exhibited amazing price gratitude, with early adopters of assets like Bitcoin and Ethereum realizing significant gains.

Another key advantage is the diversification opportunity that cryptocurrencies give. As a non-correlated asset class, cryptocurrencies can work as a bush versus standard market volatility, enabling financiers to spread their dangers throughout various financial investment lorries. This diversity can improve general portfolio efficiency.

In addition, the decentralized nature of cryptocurrencies supplies a degree of autonomy and control over one's assets that is often doing not have in traditional financing. Investors can handle their holdings without middlemans, potentially reducing costs and boosting transparency.

Additionally, the expanding acceptance of cryptocurrencies in mainstream finance and business even more solidifies their worth proposal. Many organizations currently accept copyright settlements, leading the way for more comprehensive adoption.

Last but not least, the technological innovation underlying cryptocurrencies, such as blockchain, offers chances for financial investment in arising sectors, consisting of decentralized finance (DeFi) and non-fungible symbols (NFTs), enriching the financial investment landscape.

Major Threats to Think About

One more critical danger is regulative unpredictability. Governments around the globe are still formulating plans concerning cryptocurrencies, and adjustments in regulations can considerably impact market dynamics - order cryptocurrencies. A negative regulatory atmosphere can restrict trading or perhaps cause the outlawing of certain cryptocurrencies

Safety threats also position a substantial threat. Unlike conventional monetary systems, cryptocurrencies are at risk to hacking and fraud. Investor losses can happen if exchanges are hacked or if personal tricks are endangered.

Lastly, the lack of consumer securities in the copyright area can leave financiers at risk - order cryptocurrencies. With minimal recourse in the event of fraud or theft, individuals may find it challenging to recuperate lost funds

Due to these dangers, detailed study and risk assessment are crucial before engaging in copyright investments.

Strategies for Successful Spending

Establishing a robust strategy is crucial for browsing the complexities of copyright investment. Capitalists ought to begin by performing complete research study to understand the underlying modern technologies and market dynamics of various cryptocurrencies. This consists of staying educated regarding trends, governing advancements, and market view, which can substantially influence property performance.

Diversity is one more key method. By spreading financial investments across numerous cryptocurrencies, investors can minimize dangers connected with volatility in any type of solitary asset. A healthy portfolio can supply a buffer against market variations while improving the possibility for returns.

Setting clear financial investment goals is important - order cryptocurrencies. Whether going for temporary gains or long-lasting wide range accumulation, defining details objectives assists in making educated decisions. Carrying out stop-loss orders can also safeguard financial investments from significant recessions, permitting a disciplined departure method

Last but not least, continuous tracking and reassessment of the financial investment strategy is crucial. The copyright landscape is vibrant, and routinely examining efficiency versus market problems ensures that financiers stay dexterous and receptive. By adhering to these strategies, financiers can improve their possibilities of success in the ever-evolving globe of copyright.

Future Trends in copyright

As capitalists refine their strategies, understanding future patterns in copyright ends up being progressively crucial. The landscape of electronic currencies is evolving quickly, affected by technical advancements, governing developments, and shifting market dynamics. One significant trend is the rise of decentralized finance (DeFi), which aims to recreate conventional financial systems using blockchain technology. DeFi protocols are gaining grip, supplying cutting-edge economic items that might reshape how people involve with their possessions.

One more emerging fad is the expanding institutional interest in cryptocurrencies. As firms and monetary organizations adopt electronic currencies, mainstream approval is likely to increase, possibly resulting in greater rate stability and liquidity. Additionally, the assimilation of blockchain innovation right into different industries tips at a future where cryptocurrencies act as a foundation for transactions throughout industries.

Developments in scalability and energy-efficient consensus systems will certainly resolve concerns surrounding transaction informative post speed and environmental effect, making cryptocurrencies a lot more sensible for day-to-day usage. Understanding these trends will be essential for financiers looking to navigate the complexities of the copyright market successfully.

Final Thought

Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!